TAYLOR & WILLIS CPAs AND ADVISORS

Building Valued Relationships through Commitment and Collaboration

TAYLOR AND WILLIS is a leader in TAX & ACCOUNTING solutions

We are dedicated to providing our clients with the most efficient and effective solutions to meet all of their tax, accounting, and consulting needs.

Professionalism

As one of the leading CPA firms in Metairie, Slidell, and the New Orleans Metro area, we provide dedicated financial expertise across the New Orleans metro area. Our team brings skill, experience, and personalized attention to every client.

- A team-driven approach for better financial solutions

- High standards that set us apart from other firms

- Commitment to personalized service for every client

We’re here to support your financial success. Call today to speak with a certified public accountant.

Financial Services You Can Rely On

Our firm delivers fast, accurate financial services for businesses and individuals. We focus on clear communication and reliable solutions to help you stay on track.

- Experienced professionals who prioritize accuracy

- Personalized services tailored to your needs

- Strong client relationships built on results

We’ve earned recognition in the financial industry through dedication and expertise.

Helping You Make Smart Financial Decisions

Our firm is built on high standards and reliable service. We strive to provide clear, insightful financial guidance for every client.

- Ongoing professional education to improve expertise

- Dedicated support for tax and financial decisions

- A commitment to helping clients make informed choices

We take pride in being accessible and responsive to your needs.

OUR SERVICES

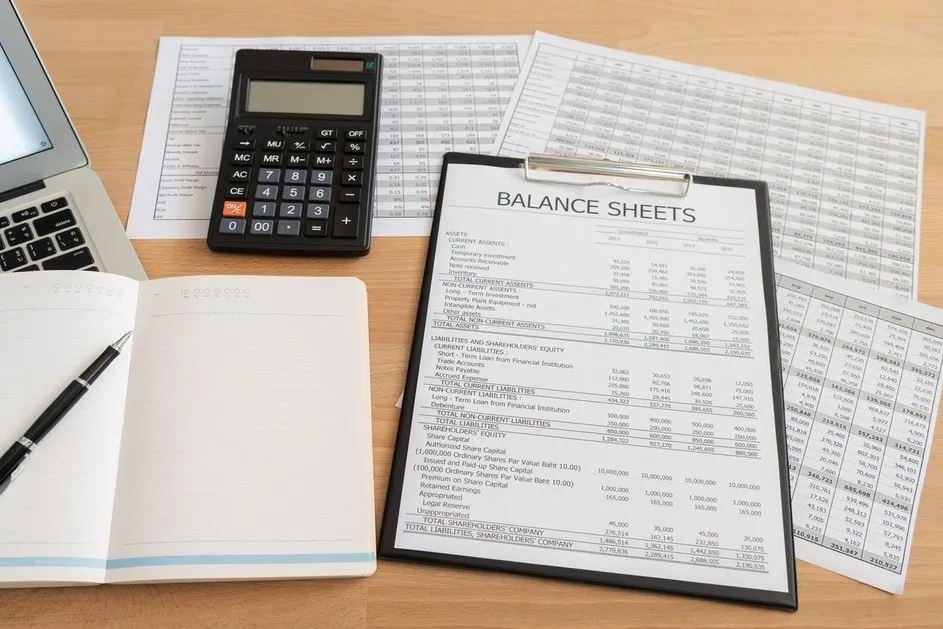

Accounting Services

Tax Services

Assurance Services

Consulting Services

Financial Statement Audits

Business Tax Returns

Tax Planning

Get A Free Quote Now!

Accounting Services

As a small business owner you have more important things to do than to keep your own books. We take care of your books for you, so you can get back to the job of running your business and generating profits.

Our services form the solid foundation of your small business accounting system. You can customize the package of services you receive by adding payroll, cash flow planning, CFO Services, or any of our other services.

Tax Services

We follow a strategic approach to fully realize your tax benefits, for all business’ structures. Our mission is to maximize your benefit from all available tax savings.

Our Tax Planning services support business growth and stability. We are with you through all phases of growth, simplifying translating complex tax code into a clear path to success.

Assurance services

Assurance services provides you with insights into your business. We support decisions with facts and detail our findings and analysis.

We provide context and a clear understanding enabling choices with confidence and focus. We assist you making decisions that drive your business growth.

Consulting Services

A Strategic Plan is much more than a tool to obtain financing. Preparing a strategic plan can help you clarify your company’s direction.

Our Consulting Services support planning that defines a blueprint describing your company, its products, the competitive environment, management team, financial health, and business risks.

Accounting Industry Insights

Stay updated with valuable tips, industry trends, and expert advice to manage your accounting, taxes, and financial planning.

Why the Best CPAs Are Also Strategic Advisors

In the rapidly evolving business world, the role of Certified Public Accountants (CPAs) has significantly expanded beyond traditional number crunching. This article delves into why the best CPAs are also indispensable strategic advisors. It will explore how they...

How a CPA Can Simplify Your Taxes

Navigating the labyrinth of tax laws and regulations can often feel like an insurmountable challenge for both individuals and businesses alike. The complexity of filing taxes, understanding potential deductions, and planning for future tax liabilities can quickly...

Louisiana Business Owners: Why You Need a CPA

As a business owner or manager in Louisiana, you're always looking for ways to grow your business and streamline your operations. One key decision that can significantly impact your success is hiring a Certified Public Accountant (CPA). While it might seem like an...